In today’s digital world, using a credit card for online purchases is a normal practice. However, many people worry about the safety of these transactions. One of the key players in ensuring your financial details stay safe is encryption. Understanding how encryption protects credit card transactions can help you feel more secure when making purchases online.

Encryption is like a secret code. It transforms your credit card information into a jumbled mess of characters. This means that even if someone tries to intercept your data while it’s being sent, they won’t be able to read it. It’s similar to sending a message that only the intended recipient can understand, keeping your personal information safe. Learn more about how encryption protects online messages

When you enter your credit card details on a website, such as your card number, expiration date, and CVV, this information travels through the internet. Cybercriminals are always on the lookout to steal this sensitive information. However, thanks to encryption, they face a significant challenge. Here’s how it works:

Data Encryption

Your credit card information is encrypted using complex algorithms before being sent to the payment processor. This means the original information is transformed into a code that looks nothing like the actual data. Learn about AES encryption and how it works

Secure Socket Layer (SSL)

Most secure websites use SSL technology to provide a secure connection. When you see “https://” in the website URL, it indicates that the site is using SSL to encrypt the data being transmitted. Learn what is SSL and TLS explained for beginners

Tokenization

Some payment systems go a step further by using tokenization. Instead of sending your actual credit card numbers, they replace them with unique identification symbols or tokens. This way, even if someone intercepts the information, they cannot use it.

The benefits of encryption for credit card transactions can’t be overstated. Here are a few key advantages:

- Protects Personal Information: Encryption ensures that your sensitive data remains confidential, which protects you from identity theft.

- Builds Consumer Trust: When customers know that their information is encrypted, they are more likely to make purchases. Trust is crucial in online shopping.

- Reduces Fraud: By making it difficult for cybercriminals to access credit card information, encryption helps to minimize the risk of fraudulent transactions.

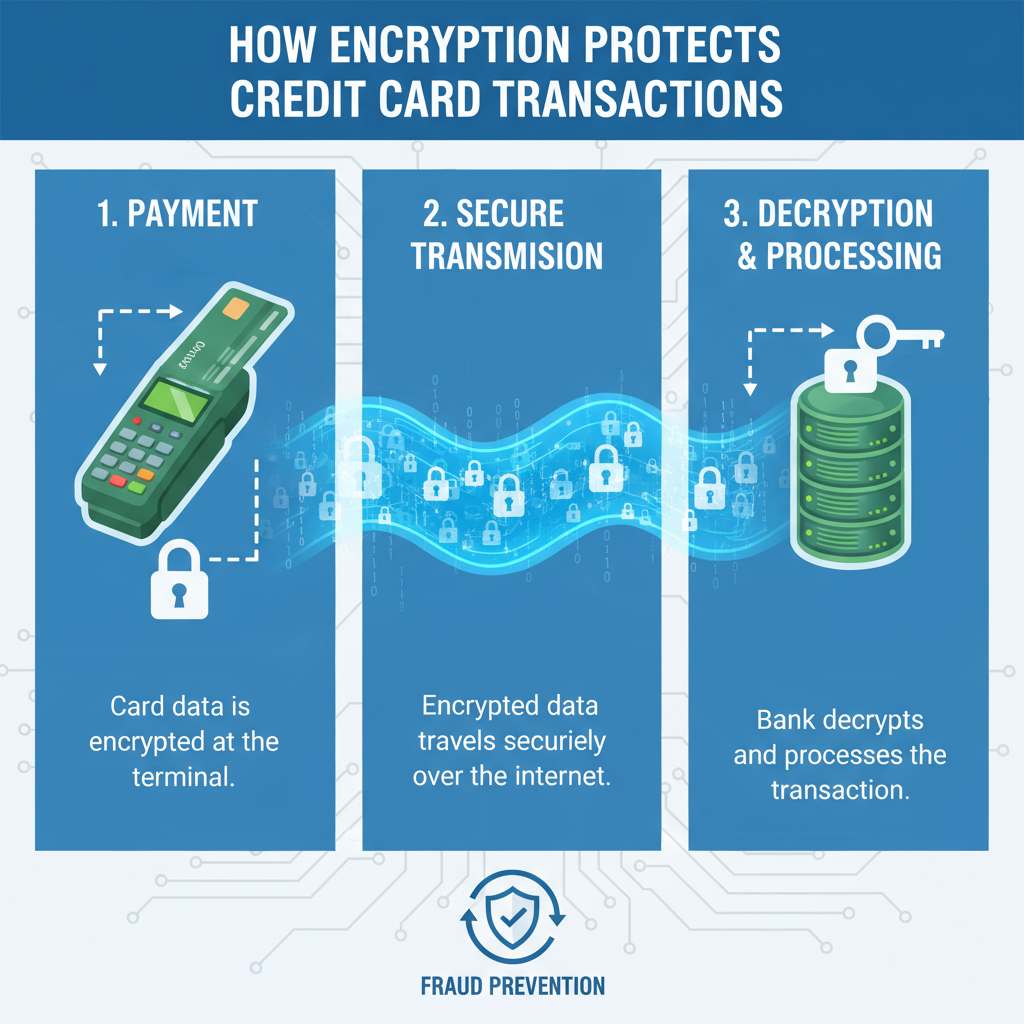

To better understand the importance of encryption, it’s useful to think about the process involved during a purchase. Imagine you’re buying a new pair of shoes online. Here’s a step-by-step look at how encryption protects your credit card:

- You select the shoes and proceed to checkout.

- You enter your credit card details on a secure page.

- The website encrypts your information instantly, changing it into a coded form.

- The encrypted data is sent to the payment processor, which securely decrypts it to authorize the transaction.

- Your purchase is completed, and the merchant receives confirmation without ever seeing your unencrypted credit card information.

This process happens quickly, often in a matter of seconds. All you have to do is sit back and enjoy your new shoes knowing that your personal information is protected.

Additionally, encryption methods continue to evolve to stay ahead of cyber threats. Innovations such as end-to-end encryption help create even safer transactions. This method encrypts data on your device and only decrypts it once it reaches the final destination, further securing your information.

As a consumer, you can also take steps to enhance your security. Always make purchases on websites that use HTTPS and look for security badges before entering your credit card details. Being aware of these safety measures will protect you while you shop online. Learn what is HTTPS and why it’s more secure

Encryption plays a vital role in protecting credit card transactions. By converting personal data into an unreadable format, it helps secure your financial information against theft. The combination of encryption and secure payment processing not only keeps your transactions safe but also boosts your confidence as you shop online.

With a grasp of how encryption protects your credit card transactions, you’re now equipped with vital knowledge that enhances your online shopping experience.

How SSL Certificates Enhance Online Payment Security

In today’s digital landscape, where online shopping and financial transactions are commonplace, ensuring security during these activities is crucial. One key element that plays a significant role in protecting sensitive information is the SSL certificate. This technology not only safeguards your personal data during online payments but also enhances customer trust. Let’s explore how SSL certificates enhance online payment security.

What is an SSL Certificate?

An SSL (Secure Socket Layer) certificate is a type of digital certificate that provides authentication for a website and enables an encrypted connection. This encryption is essential when transmitting sensitive data, such as credit card numbers and personal information. When you purchase something online, SSL encrypts the data that travels between your computer and the server, making it nearly impossible for hackers to steal that information. Learn what is SSL and TLS explained for beginners

How does SSL Encryption Work?

The magic of SSL encryption lies in its ability to create a secure tunnel for data transfer. This process involves the following steps:

- Handshake: When you connect to a website with an SSL certificate, a handshake occurs between your browser and the server. They agree on the encryption methods to use.

- Certificate Exchange: The server sends its SSL certificate to your browser. Your browser checks if the certificate is valid and that it’s from a trusted certificate authority.

- Session Keys Generation: Both your browser and the server generate session keys that will encrypt and decrypt the data during your session.

- Secure Data Transfer: Now that both parties have established a secure connection, they can safely transmit data over the internet, knowing it is encrypted.

Why SSL Certificates are Essential for Online Payments

The importance of SSL certificates in safeguarding online transactions cannot be overstated. Here are some critical reasons:

- Data Protection: With SSL encryption, any information you send, like credit card details, is rendered unreadable to anyone intercepting it. This means that even if hackers manage to intercept your data, they cannot decipher it.

- Customer Trust: Displaying an SSL certificate lends credibility to your website. When customers see the padlock symbol in the browser bar, they gain confidence that their information is secure, leading to higher conversion rates.

- Compliance with Regulations: Many financial regulations and compliance standards, like PCI DSS (Payment Card Industry Data Security Standard), require the use of SSL certificates. Having SSL in place ensures that your business adheres to these essential regulations.

- Protection from Phishing: SSL certificates help identify legitimate websites. Phishing sites often lack SSL certificates, so having one can act as a deterrent against scams. Learn what is a phishing attack

The Benefits of HTTPS

Websites using SSL certificates are accessible via HTTPS instead of HTTP. This simple change from HTTP to HTTPS comes with various benefits:

- Increased Search Rankings: Search engines like Google reward secure websites. Having an SSL certificate can improve your site’s ranking in search results, attracting more visitors.

- Enhanced User Engagement: Users are more likely to stay on your site if they feel secure. Lower bounce rates mean better engagement and the possibility of converting visitors into customers.

- Improved Data Integrity: SSL prevents data from being corrupted or altered during transmission. This means that customers can trust the information they receive when making decisions about purchases.

Choosing the Right SSL Certificate

There are various types of SSL certificates to fit different needs:

- Domain Validated (DV): Ideal for personal websites, providing basic encryption.

- Organization Validated (OV): Suitable for businesses, requiring some verification of the organization.

- Extended Validation (EV): The highest level of trust. It requires extensive verification, which is beneficial for e-commerce websites.

If you manage a website that processes online payments, investing in an SSL certificate is a must. It not only protects your customers’ sensitive information but also builds trust and credibility for your business. In a world where online security threats are rampant, SSL certificates stand as a robust defense mechanism. With ever-increasing cyber vulnerabilities, ensuring your transactions online are secure should be a top priority. Learn what is cybersecurity

Understanding Tokenization: A New Standard for Payment Protection

In today’s digital world, security is everything, especially when it comes to payment systems. Understanding tokenization is critical for anyone who shops online or manages transactions. But what exactly is tokenization and how does it work? Let’s explore this payment protection standard in detail.

Tokenization refers to the process of replacing sensitive data associated with payment information, like credit card numbers, with a unique identification symbol called a token. This token is then used to process transactions without exposing the actual payment details. By utilizing this system, businesses can greatly minimize the risks associated with data breaches and fraud.

So, how does this process work? Here’s a simple breakdown:

- Customer Initiates Payment: When you decide to make a purchase, you enter your credit card information at the checkout.

- Token Generation: Instead of keeping this sensitive information, the payment processor creates a token, which is a randomly generated string of characters.

- Transaction Processing: This token is sent through secure channels to the payment gateway and used for the transaction.

- Data Stored Securely: The original credit card information is stored securely in a vault, while the merchant only holds the token.

- Payment Verification: When the transaction is finalized, the payment processor retrieves the original credit card information using the token for verification.

This system greatly enhances payment security for both businesses and consumers. Since the actual credit card number is never transmitted or stored in the transaction process, it drastically reduces the chance of sensitive information being intercepted by hackers. If a data breach does occur, hackers gain access only to the tokens, which are of no use without the vault that stores the original card numbers.

Many companies, including giants like Apple, Amazon, and PayPal, have successfully integrated tokenization into their payment systems. This integration has led to increased customer trust and loyalty, as consumers feel more secure making purchases. They know that their sensitive information is protected, enabling them to shop with peace of mind.

Tokenization also adheres to strict compliance requirements such as PCI DSS (Payment Card Industry Data Security Standard). This set of standards ensures that companies take appropriate measures to protect cardholder data. By adopting tokenization, businesses demonstrate a commitment to safeguarding customer information. This is not only good for customers but also promotes positive brand reputation and can lead to higher sales.

Another significant advantage of tokenization is its ability to streamline the payment process. Since merchants don’t have to handle sensitive data, they can focus on improving customer service and enhancing user experience. Quick and secure transactions create a hassle-free checkout experience, which ultimately keeps customers returning.

Despite its numerous advantages, tokenization does come with some challenges. For example, implementing a tokenization solution might require significant investment in technology and training. However, the long-term benefits of reduced fraud and increased consumer trust often outweigh these initial costs.

Tokenization is revolutionizing the landscape of payment protection. This innovative technology offers a secure way to conduct transactions by replacing sensitive data with tokens, thereby protecting users against potential threats. As more businesses adopt this system, consumers can enjoy a safer and more reliable online shopping experience. As a business owner, embracing tokenization could mean a more secure future for both you and your customers.

By understanding the dynamics of tokenization, consumers and merchants can make informed decisions about payment security. It’s clear that as we move further into a digital era, technologies like tokenization will play a vital role in protecting financial transactions. Therefore, always look for businesses that prioritize the security of your payment information through advanced solutions such as tokenization.

The Impact of Data Breaches on Consumer Trust in Online Shopping

Data breaches are becoming increasingly common, especially in the world of online shopping. When these security incidents occur, they can severely impact consumer trust. Trust is a cornerstone of any transaction, particularly when sensitive information, like credit card numbers and personal details, are involved. Understanding how data breaches affect consumer behavior can help businesses take the necessary steps to protect their customers and maintain trust.

First and foremost, let’s look at what a data breach entails. A data breach is an incident where unauthorized individuals gain access to sensitive data. This can include usernames, passwords, credit card information, and personal identification details. When such breaches happen, consumers are understandably worried about the safety of their information. The fear of identity theft and fraud can make customers hesitant to shop online. In fact, studies indicate that over 60% of consumers stop shopping on a website after a significant data breach has been reported. Learn about types of cyber threats explained

One of the strongest impacts of data breaches is that they change how consumers view the trustworthiness of a business. Trust is built on transparency and security. If a company shows weakness in safeguarding data, consumers will question its reliability. They wonder if their information is safe and may prefer to shop elsewhere, particularly with companies that prioritize security measures.

Moreover, consistent data breaches tend to have a snowball effect. If one retailer experiences a breach, it can influence how the entire sector is perceived. Consumers may become skeptical about sharing their information not only with a single retailer but with all online shopping platforms. This skepticism can lead to reduced sales and lower revenue for many businesses. To put it simply, a single breach can tarnish the collective reputation of the industry.

Trust can be rebuilt, but it takes time and effort. Here are some strategies businesses can employ to regain consumer trust after a breach:

- Transparent Communication: Companies should inform their customers about breaches as soon as they happen. Explain how the breach occurred, what information was compromised, and how the business plans to enhance security moving forward.

- Offer Support: Provide affected customers with resources such as credit monitoring services or support hotlines. This shows that you care about their well-being.

- Enhance Security Measures: Invest in robust security systems and protocols to prevent future breaches. This includes using encryption, secure payment gateways, and continuous monitoring systems.

- Engage in Community Building: Foster an ongoing relationship with customers through newsletters, social media engagement, and regular updates on security enhancements.

Another contributing factor to the loss of trust after a data breach is the aftermath. Many consumers experience anxiety and fear of potential fraud after their personal information has been exposed. Even when businesses take steps to improve security, consumers may remain wary. They might be less likely to shop online, opt for cash transactions, or even consider local retail options. This fear can drastically change shopping habits and impact sales analytics for online retailers.

Customers’ willingness to shop is also influenced by the perceived value of the shopping experience. If trust is compromised, customers may not only stop purchasing from the affected business but may also share negative experiences with friends and family, amplifying the impact of the breach. Businesses need to understand that word-of-mouth is powerful. A single dissatisfied customer can result in the loss of many potential buyers.

Additionally, a data breach can lead to legal consequences for companies. Consumer protection laws mandate that businesses must safeguard customer information. Failing to do so can lead to lawsuits, fines, and regulatory scrutiny, further hurting a company’s reputation and finances.

The path to restoring trust is long, but it’s essential for the viability of any online business. By prioritizing customer security, being honest about vulnerabilities, and showing a commitment to protecting consumer data, businesses can rebuild their reputation over time. Remember, in the age of online shopping, consumer trust is invaluable. Protecting that trust is everyone’s responsibility, from executives to grocery clerks.

Best Practices for Securing Your Credit Card Information While Shopping Online

With more people shopping online every day, ensuring your credit card information remains secure is crucial. Protecting your financial information while having a seamless shopping experience requires adopting several best practices. This guide covers essential steps to help you shop online safely and securely.

Use Secure Websites

When shopping online, always ensure that the website is secure. Look for “https://” at the beginning of the URL. The ‘s’ in ‘https’ stands for secure, indicating that the website uses encryption to protect your data during transmission. Avoid sites that don’t have this security feature, as they may leave your credit card information vulnerable to hackers. Learn what is HTTPS and why it’s more secure

Enable Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your online accounts. This feature requires you to provide two forms of verification before accessing your account, usually your password and a code sent to your mobile device. By enabling 2FA, you significantly reduce the risk of someone gaining unauthorized access to your credit card information. Learn what is two-factor authentication (2FA) and how it works

Use Strong, Unique Passwords

Creating strong and unique passwords for each of your online accounts can protect your credit card information effectively. Here’s how to create secure passwords:

- Use at least 12 characters, including a mix of uppercase, lowercase, numbers, and symbols.

- Avoid using easily guessed information like birthdays or pet names.

- Consider using a password manager to help you remember complex passwords safely.

Regularly Monitor Your Statements

Always keep an eye on your bank and credit card statements. Regularly monitoring your statements helps you quickly spot any unauthorized charges. If you notice something suspicious, report it to your bank immediately. The faster they know, the quicker they can help secure your account.

Use Virtual Credit Cards

Some financial institutions offer virtual credit cards, which provide an extra layer of security when shopping online. These cards generate temporary numbers linked to your main account. When shopping, you can use the virtual card instead of your actual credit card number. This way, even if someone steals the virtual number, it won’t lead back to your real account.

Shop Only at Trusted Retailers

Before entering your credit card information, make sure the retailer is reputable. Look for reviews and ratings from other customers. Stick to well-known brands and organizations whose websites you trust. If a deal seems too good to be true, it probably is. Never provide your credit card details to unfamiliar or suspicious websites.

Keep Your Devices Secure

Ensure that your computer, smartphone, or tablet is secure. Install reputable antivirus software and keep it updated to help protect against malware and spyware that could target your financial information. Also, keep your operating system and apps updated, as these updates often include security improvements.

Be Wary of Public Wi-Fi

Using public Wi-Fi networks can expose your information to hackers. Avoid accessing sensitive accounts or making purchases over public Wi-Fi. If you must make online purchases or access sensitive data while on the go, consider using a reliable virtual private network (VPN) service. A VPN encrypts your internet connection, protecting your personal information from prying eyes. Learn why you should use VPN on public Wi-Fi

Watch Out for Phishing Scams

Phishing scams often come in the form of emails or messages that appear legitimate but aim to steal your personal information. Be cautious when clicking on links in emails or messages, especially if they ask for your credit card details. If you receive a suspicious message, verify its authenticity by contacting the company directly through their official website. Learn what is a phishing attack

By following these best practices, you can significantly reduce the risk of your credit card information being compromised while shopping online. Protecting your financial information takes a bit of effort, but the peace of mind you gain is worth it. With the right measures in place, you can focus on enjoying your online shopping experience without worry.

Conclusion

Understanding “how encryption protects credit card transactions” is vital for anyone engaging in online shopping. Encryption acts as the backbone of secure payment processes, transforming sensitive information into unreadable code that can only be decrypted by authorized parties. By utilizing SSL certificates, websites establish an extra layer of trust and establish secure connections, ensuring that data shared between the customer and the merchant remains confidential.

Tokenization emerges as a formidable strategy in protecting payment information by substituting sensitive card details with unique identifiers. This means, even if a database is breached, the attackers only access worthless tokens instead of actual credit card numbers. Such measures significantly bolster the security infrastructure that consumers rely on.

However, it’s crucial to acknowledge the impact of data breaches on consumer trust. Frequent reports of stolen credit card data can leave shoppers feeling vulnerable and hesitant to make online purchases. This highlights the need for merchants to prioritize security to maintain customer loyalty and confidence.

As a savvy shopper, you can also take steps to secure your personal information. Using reputable websites, enabling two-factor authentication, and regularly monitoring your financial statements can significantly reduce your risk of fraud.

By embracing these encryption technologies and best practices, both consumers and merchants can contribute to a more secure digital shopping environment. Investing in encryption and remaining vigilant are essential steps toward a safer online shopping experience, assuring that transactions are not only convenient but also secure.